Second home mortgage how much can i borrow

Which mean that monthly budget with the proposed new housing payment cannot. Borrowers with good credit can typically borrow up to 80 of their homes current value.

Pin On Real Estate

But ultimately its down to the individual lender to decide.

. If you want a more accurate quote use our affordability calculator. Fill in the entry fields. But the more you can put down the better chance youll have of getting the most competitive deals.

We do not offer 95 LTV residential. For example lets say the borrowers salary is 30k. How much deposit for a second home.

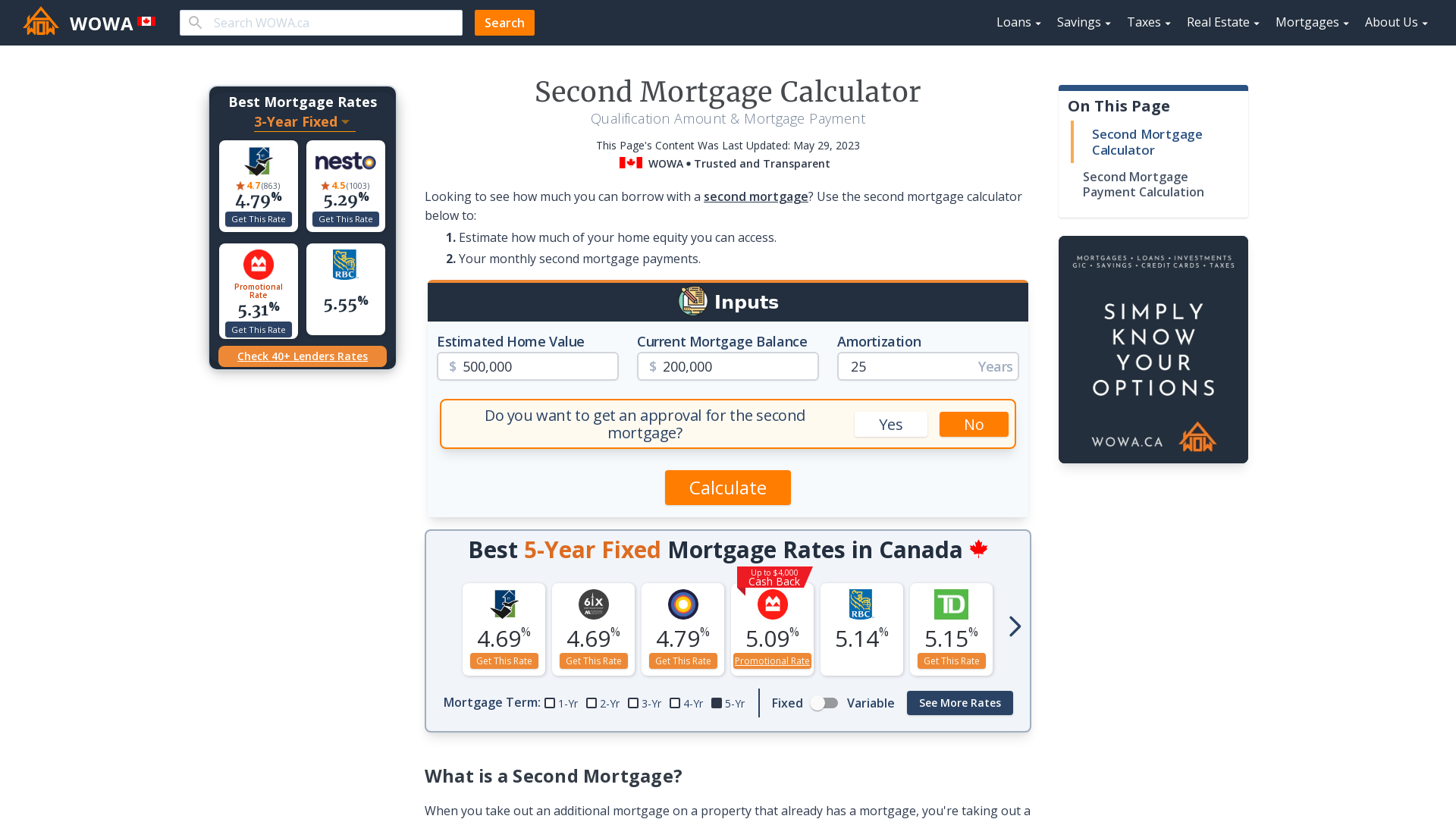

Most second home mortgages require at least a 15 deposit and you may need to put down even more than that if your current income wont cover a second mortgage for the. Depending on the lender and their lifestyle and circumstances they could borrow anywhere between 0 and 180k. With your existing mortgage you can borrow up to a combined 80 of your homes value with a HELOC or a home equity loan as a second mortgage.

The maximum size of a HELOC on its. This mortgage calculator will show how much you can afford. Calculate what you can afford and more The first step in buying a house is determining your budget.

Most lenders will use 45x your salary some may go up to. The minimum mortgage deposit you would need on a second home would be 10 ie. If youre buying a second residential home youll generally need at least a 10-15 deposit.

Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. Are assessing your financial stability ahead of. For example if you had 150000 home equity after years of mortgage repayments a second charge mortgage with an 80 LTV would allow you to borrow 120000 maximum.

A lenders in-house second mortgage calculator will usually give an indication based on a multiple of your income. This borrowing calculator is intended as a guide only and is based on the Residential Owner Occupied rate. As part of an.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. To calculate how much you can borrow against your home for a second mortgage loan at 90 LTV use the following calculation in the example below. In order to calculate how much you could borrow we need to.

2 x 30k salary 60000. Banks however frequently need a good credit score for you to get approved. The Maximum Mortgage Calculator is most useful if you.

A 90 LTV mortgage. Second home mortgage borrower requirements The most important requirement is that you need at least a 10 down payment. This rule is non-negotiable.

Want to know exactly how much you can safely borrow from your mortgage lender. To determine whether they have sufficient home equity to be approved for a HELOC prospective. The maximum debt to income ratio borrowers can have is 50 on conventional loans.

To qualify for a conventional loan on a second home you will typically need to meet higher credit score standards of 725 or even 750 depending on the lender. Before you go this direction make sure you can afford the larger monthly payment youll now owe on.

Any Agent Worth His Money Will Have Good Contacts With All The Major Banks And Private Lenders In Toronto This Works In Y Private Lender The Borrowers Lenders

Nwiozvluu7kdum

Getting A Second Mortgage Td Canada Trust

Vintage House Plans 1960s Cottages And Second Homes Vacation House Plans Vintage House Plans Vintage House Plans 1960s

12 Things Canadians Don T Know About Second Mortgages Canadian Mortgages Inc

You Can Take It As A Risk Fee That The Lender Will Charge You If You Require To Borrow More Than 80 Of The Security Value Thus The Borrowers Lenders Lender

The Ultimate Real Estate Loan Guide Infographic Health Mortgage Payment Calculator Cleveland Clinic

Another Monday Another Mortgage Glossary Term Let Us Tell You A Little Bit About Appreciation Appreciati Home Equity Line Of Credit Mortgage Interest Rates

Pin On Mortgage Madness

Getting A Second Mortgage Td Canada Trust

Insights About Canada S Most Pricey Real Estate Market Real Estate Buying Real Estate Investing Real Estate

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

A Home Loan Or Mortgage Is When You Borrow Money From Another Person Or Institution To Pay For A Property Gettos In 2022 The Borrowers Borrow Money Home Loans

Heloc Infographic Heloc Commerce Bank Mortgage Advice

Interested In Borrowing Against Your Home S Available Equity To Pay For Other Expenses The Good News Is You Have Ch Home Equity Line Of Credit Mortgage Payoff

Pin On Mortgage And Loan

Getting A Second Mortgage Td Canada Trust